Chinese language menace actors have developed a harmful new solution to steal cash instantly from financial institution accounts utilizing specifically crafted Android functions.

Often called Ghost Tapped, these malicious apps exploit Close to Subject Communication (NFC) know-how, the identical wi-fi know-how that powers contactless funds.

As a substitute of needing your bodily financial institution card, criminals can full transactions from wherever on this planet by merely relaying fee data by their very own units.

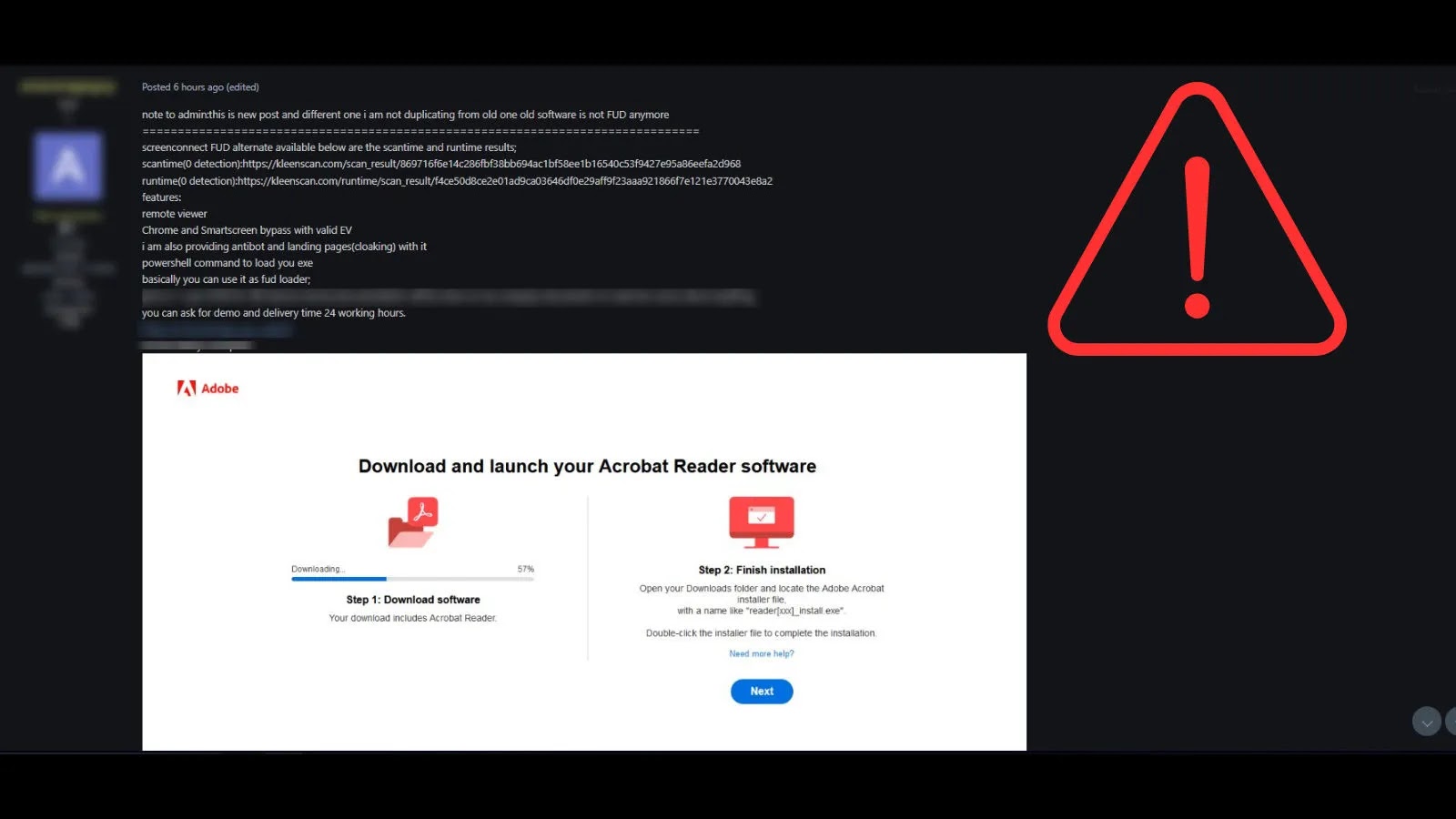

The assault works in a surprisingly easy but efficient method. Victims are focused by misleading messages and telephone calls, tricked into downloading malicious APK information that seem like legit banking or fee apps.

As soon as put in, customers are requested to faucet their financial institution playing cards towards their telephones, believing they’re registering the cardboard for safety functions.

Unknown to them, the app captures card knowledge and sends it to a command-and-control server operated by the criminals.

From August 2024 by August 2025, safety specialists recognized over 54 completely different variations of those malicious functions, with greater than half a dozen main variants actively being offered and promoted on Telegram.

Group-IB analysts recognized that the malware operates by a two-part system: a “reader” utility put in on the sufferer’s gadget that captures fee card data, and a “tapper” utility utilized by criminals to finish unauthorized transactions at shops and ATMs.

The An infection Mechanism and Relay Assault

Group-IB researchers famous that the malware operates by establishing a direct relay between a sufferer’s fee card and a legal’s gadget by internet-connected servers.

TX-NFC Pricing data & function checklist (Supply – Group-IB)

When a card is tapped to an contaminated Android telephone working the reader app, the fee knowledge is captured and encrypted.

This knowledge travels by the C2 server and reaches the legal’s tapper utility, which then forwards it to actual point-of-sale terminals stolen or fraudulently obtained from legit fee processors.

To the POS terminal, the transaction seems fully legit, as if the legal’s gadget itself had been an actual financial institution card.

The technical implementation reveals refined engineering. The functions request particular NFC permissions together with android.permission.NFC and android.permission.INTERNET to perform.

Upon set up, they acquire gadget identifiers and authentication credentials, sending this data to distant servers utilizing WebSocket or MQTT protocols.

Between November 2024 and August 2025, one related group processed at the very least $355,000 in fraudulent transactions utilizing this methodology.

1000’s of victims globally have already fallen sufferer to those schemes, with arrests occurring in a number of nations together with the USA, Singapore, Czech Republic, and Malaysia, demonstrating the assault’s rising real-world impression.

Observe us on Google Information, LinkedIn, and X to Get Extra Prompt Updates, Set CSN as a Most well-liked Supply in Google.