Darknet markets, working past the attain of conventional fee processors and authorized techniques, depend on escrow techniques to safe cryptocurrency transactions between patrons and distributors.

These techniques, utilizing multisignature wallets and automatic launch mechanisms, goal to make sure transaction safety and facilitate dispute decision.

Nonetheless, vulnerabilities in centralized dispute processes and the persistent risk of exit scams spotlight important dangers, as detailed in a latest evaluation of darknet market operations.

Multisig Escrow: Balancing Safety and Belief

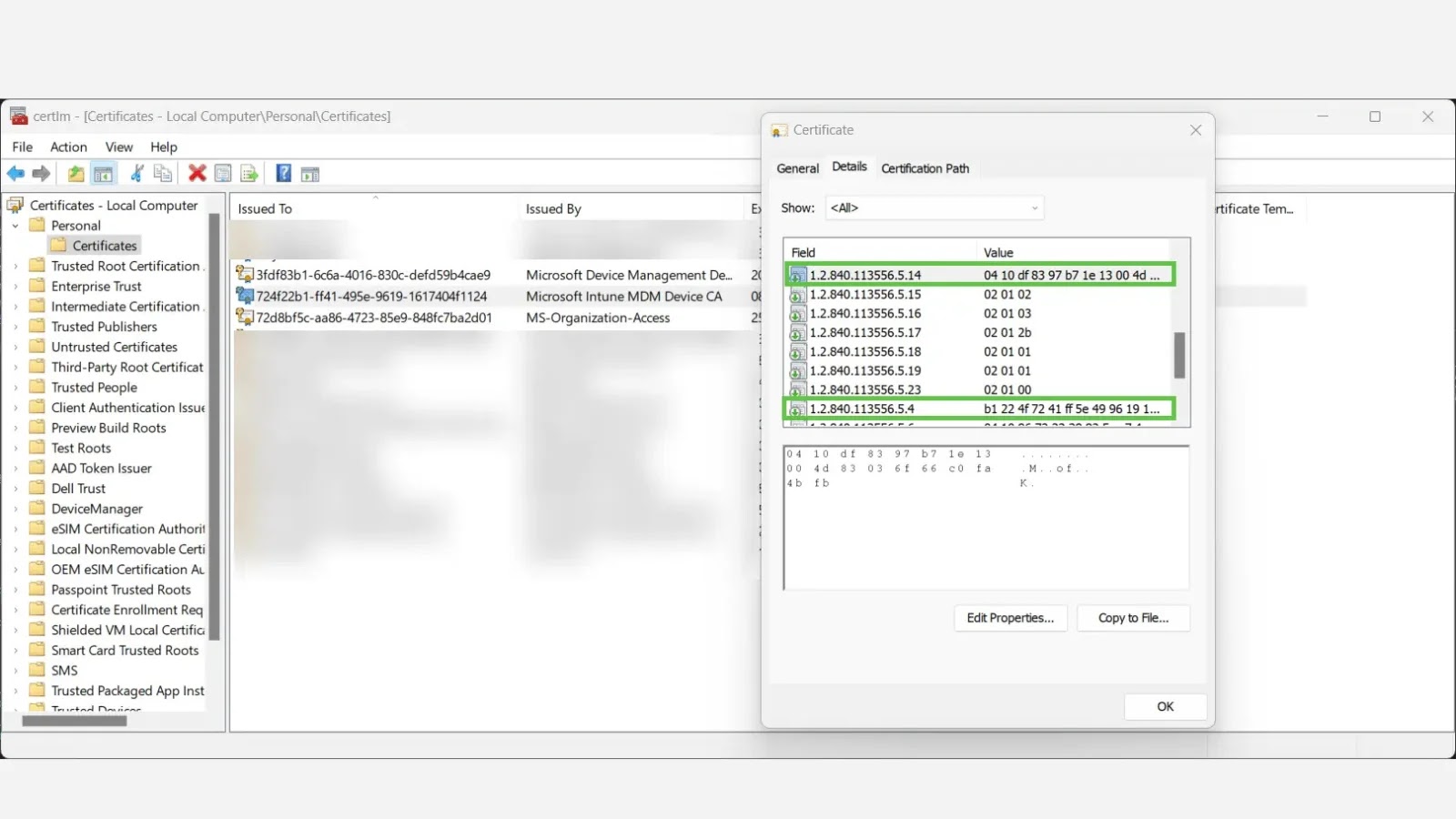

Fashionable darknet markets generally make use of multisignature (multisig) escrow techniques, usually utilizing a 2-of-3 signature mannequin involving the customer, vendor, and market administrator.

When a purchaser locations an order, funds are locked in a multisig tackle requiring two signatures to launch—normally the customer and vendor for profitable transactions, with the administrator stepping in for disputes. This setup prevents any single celebration from accessing funds unilaterally, providing stronger safety than centralized escrow techniques the place markets maintain funds instantly.

In accordance with Sam Bent Report, In a typical transaction, the market platform generates the multisig tackle, distributing non-public keys to the customer and vendor, although some markets permit customers to produce their very own keys for added management. Profitable transactions see patrons and distributors signing to launch funds to the seller with out administrator involvement.

Crypto Multisignature Pockets (Credit: sambent)

In disputes, directors use their key to allocate funds based mostly on proof like transport confirmations or product photographs. Whereas multisig wallets scale back the danger of funds theft if market servers are compromised, they nonetheless depend on belief in directors for truthful dispute decision and require customers to safeguard their non-public keys.

Automated Timers and Exit Rip-off Vulnerabilities

To streamline operations, many darknet markets use automated escrow launch techniques, transferring funds to distributors after 7 to 21 days except patrons provoke disputes.

These timers, shorter for home orders and longer for worldwide shipments, assume patrons will obtain items throughout the timeframe and solely dispute problematic transactions.

Consumers can manually launch funds early upon passable supply, benefiting distributors with sooner payouts, whereas graduated launch techniques for giant orders present partial funds to distributors whereas defending patrons.

Nonetheless, these automated techniques burden patrons with monitoring orders to dispute points earlier than deadlines, and prolonged escrow durations can pressure vendor liquidity or tempt directors into exit scams, the place they abscond with all escrowed funds. Historic information exhibits exit scams dominate darknet market closures, typically timed throughout excessive escrow volumes like vacation seasons.

The centralized dispute decision course of, reliant on directors reviewing proof, introduces dangers of bias or corruption, as directors earn charges from transactions and resolutions, doubtlessly skewing choices to favor market continuity over equity.

The inherent belief required in directors, mixed with the anonymity of darknet markets, leaves customers weak to systematic theft, prompting many to favor direct offers with trusted distributors or restrict escrow use to attenuate losses.

As darknet markets navigate the steadiness between safety and operational effectivity, the persistent risk of exit scams underscores the necessity for decentralized options to cut back reliance on centralized belief fashions.

Discover this Information Fascinating! Comply with us on Google Information, LinkedIn, and X to Get Prompt Updates!