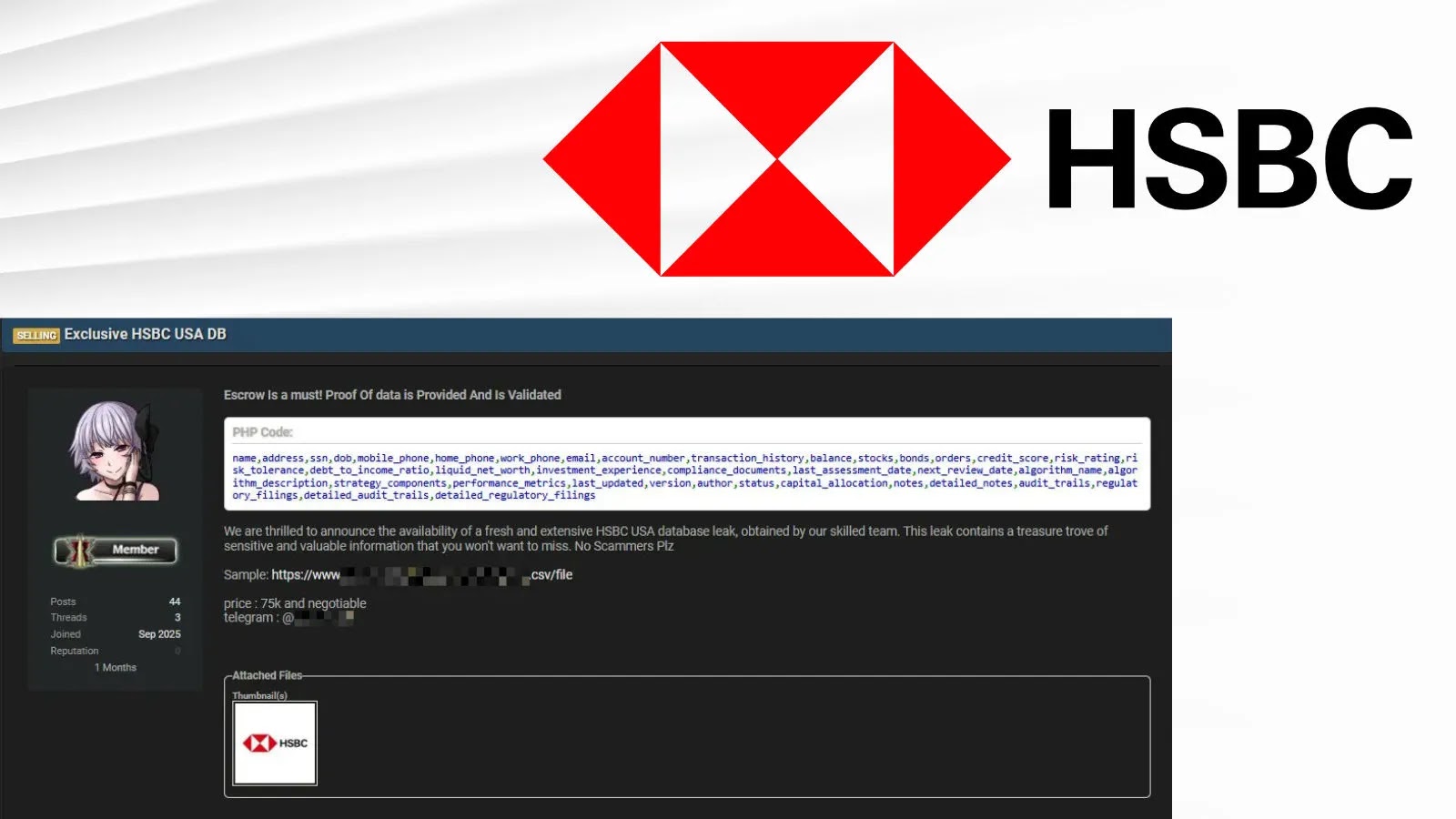

A menace actor has claimed duty for breaching HSBC USA, alleging possession of an enormous database containing delicate buyer private identifiable info (PII) and monetary particulars.

The hacker posted screenshots and information samples on a darkish net leak discussion board, asserting the breach concerned coordinated efforts to extract data from the financial institution’s programs.

This incident, reported on October 28, 2025, has raised alarms within the cybersecurity group amid HSBC’s ongoing challenges within the U.S. market.

The alleged stolen database incorporates full names, addresses, Social Safety numbers (SSNs), dates of start, telephone numbers, e-mail addresses, transaction histories, inventory orders, and checking account numbers.

HSBC USA Prospects Data

Researchers analyzed a supplied pattern and located indications of legitimacy, with the information showing current, doubtlessly from simply weeks prior, and probably focusing on company or institutional shoppers relatively than retail ones.

HSBC USA has largely exited the U.S. mass retail banking sector, which may clarify its concentrate on enterprise accounts.

The hooked up screenshot of the discussion board publish corroborates the declare, exhibiting an “Unique HSBC USA DB” with guarantees of validation and no free distribution.

HSBC’s Response and Implications

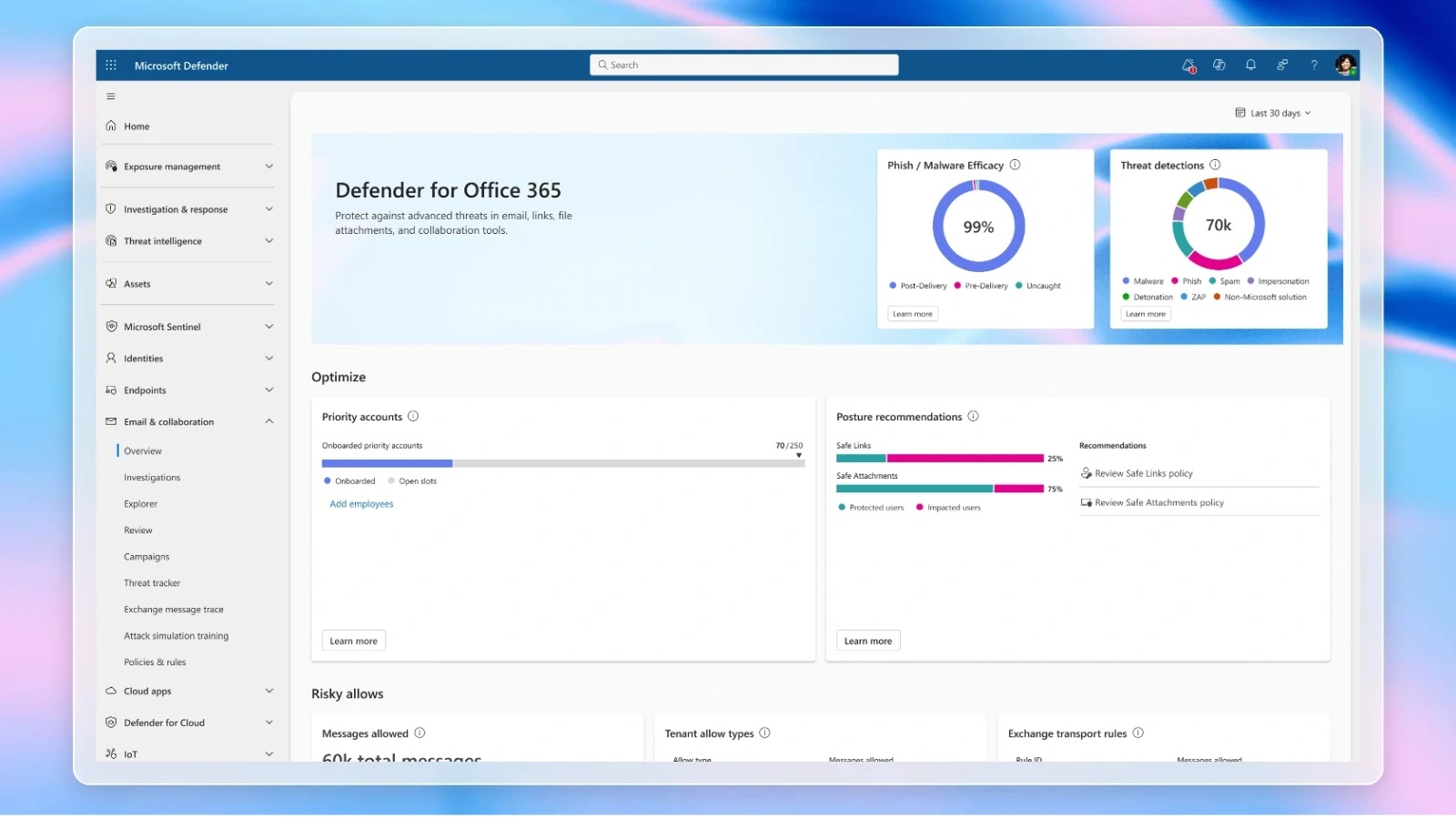

HSBC has acknowledged a current denial-of-service (DoS) assault however has firmly denied any buyer information compromise in its official statements.

The financial institution is investigating claims by way of third-party vendor entry factors and has strengthened defenses with enhanced authentication and monitoring.

No confirmed monetary losses have occurred, however consultants warn of dangers corresponding to identification theft, spear-phishing, and social engineering assaults exploiting the uncovered particulars.

Regulatory our bodies, together with the U.S. Division of the Treasury, are monitoring the state of affairs intently. This breach highlights vulnerabilities in monetary third-party ecosystems, doubtlessly damaging HSBC’s status and prompting consumer attrition.

Prospects are urged to observe accounts, allow two-factor authentication, and alter passwords instantly to mitigate potential fallout.

As investigations proceed, the complete scope stays unclear, however the occasion underscores the persistent threats going through world banks.

Observe us on Google Information, LinkedIn, and X for day by day cybersecurity updates. Contact us to characteristic your tales.