A classy new phishing framework dubbed “Spiderman” has emerged within the cybercrime underground, dramatically decreasing the barrier to entry for monetary fraud.

This toolkit, noticed by Varonis, permits risk actors, even these with minimal technical ability, to spin up pixel-perfect replicas of official banking portals in just some clicks.

The package targets prospects of dozens of European monetary establishments and cryptocurrency platforms explicitly, signaling a harmful evolution in automated cybercrime instruments.

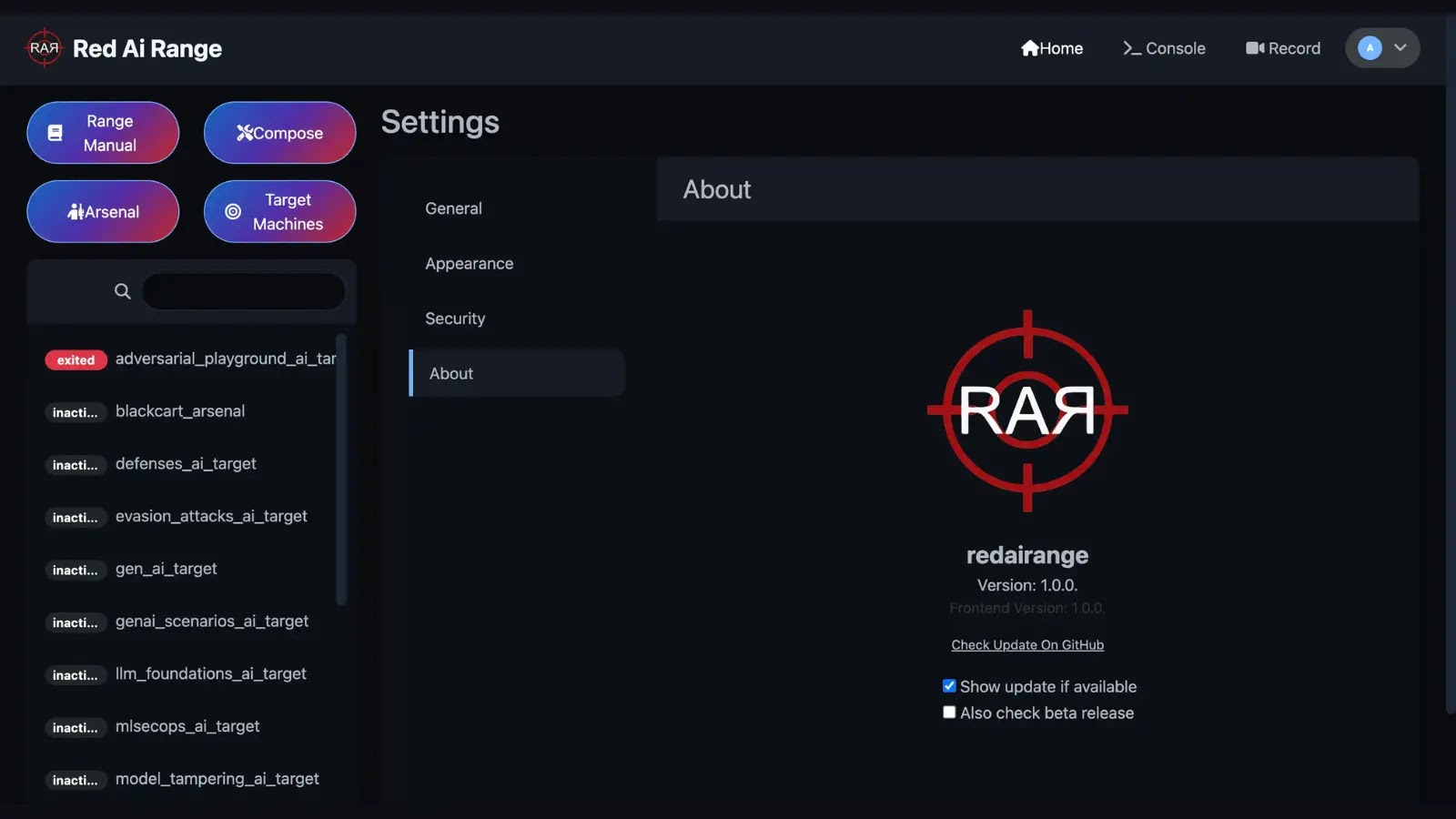

What units Spiderman aside from normal, single-target phishing scripts is its professional-grade structure and in depth automation. It features as a full-stack framework the place attackers not want net growth experience or coding information to launch campaigns.

The package consolidates focusing on for dozens of main manufacturers, together with Deutsche Financial institution, Commerzbank, ING (Germany & Belgium), and CaixaBank, right into a single, cohesive interface.

A number of Financial institution login pages

This degree of polish follows a regarding development of feature-packed instruments like SpamGPT and MatrixPDF which are making widespread assaults more and more accessible. In follow, Spiderman reduces the advanced technique of financial institution phishing to a easy choice menu.

Cybercriminals merely choose a goal establishment, click on “Index This Financial institution,” and the package routinely generates a convincing clone full with login fields, password prompts, and brand-specific aesthetics.

This effectivity permits attackers to pivot between areas and types shortly, sustaining a broad “net” of assaults throughout a number of nations concurrently.

The technical sophistication of the package is most evident in its dealing with of contemporary safety measures and stay session administration. Spiderman contains modules designed to bypass two-factor authentication (2FA) by capturing PhotoTAN codes and One-Time Passwords (OTPs) in actual time.

Because the sufferer enters credentials on the fraudulent web page, the operator can view the session stay by means of a dashboard. This enables the attacker to set off extra prompts immediately, asking the sufferer for bank card numbers, expiration dates, or secondary authentication codes wanted to authorize fraudulent transactions, Varonis stated.

Phishing Package Login Web page

Moreover, the package employs superior anti-analysis filtering to evade detection by safety researchers and automatic scanners. Attackers can configure the platform to strictly enable visitors from particular nations or machine sorts (reminiscent of iOS or Android) whereas blocking recognized safety distributors, information facilities, and VPNs.

By filtering out undesirable guests, the phishing pages stay lively longer earlier than being blacklisted by browser distributors.

The risk panorama is additional sophisticated by the package’s assist for cryptocurrency theft. Modules particularly designed to seize seed phrases for wallets like Ledger, MetaMask, and Exodus point out that operators are pursuing a hybrid fraud technique focusing on each conventional banking and digital property.

The distribution of this software is already widespread. A Sign messenger group linked to the vendor behind Spiderman at present hosts roughly 750 members, suggesting a large and lively group.

As European monetary establishments proceed to replace their e-banking flows, modular kits like Spiderman are anticipated to evolve in parallel, requiring heightened vigilance from each banking safety groups and prospects concerning URL verification and authentication requests.

Observe us on Google Information, LinkedIn, and X for day by day cybersecurity updates. Contact us to function your tales.